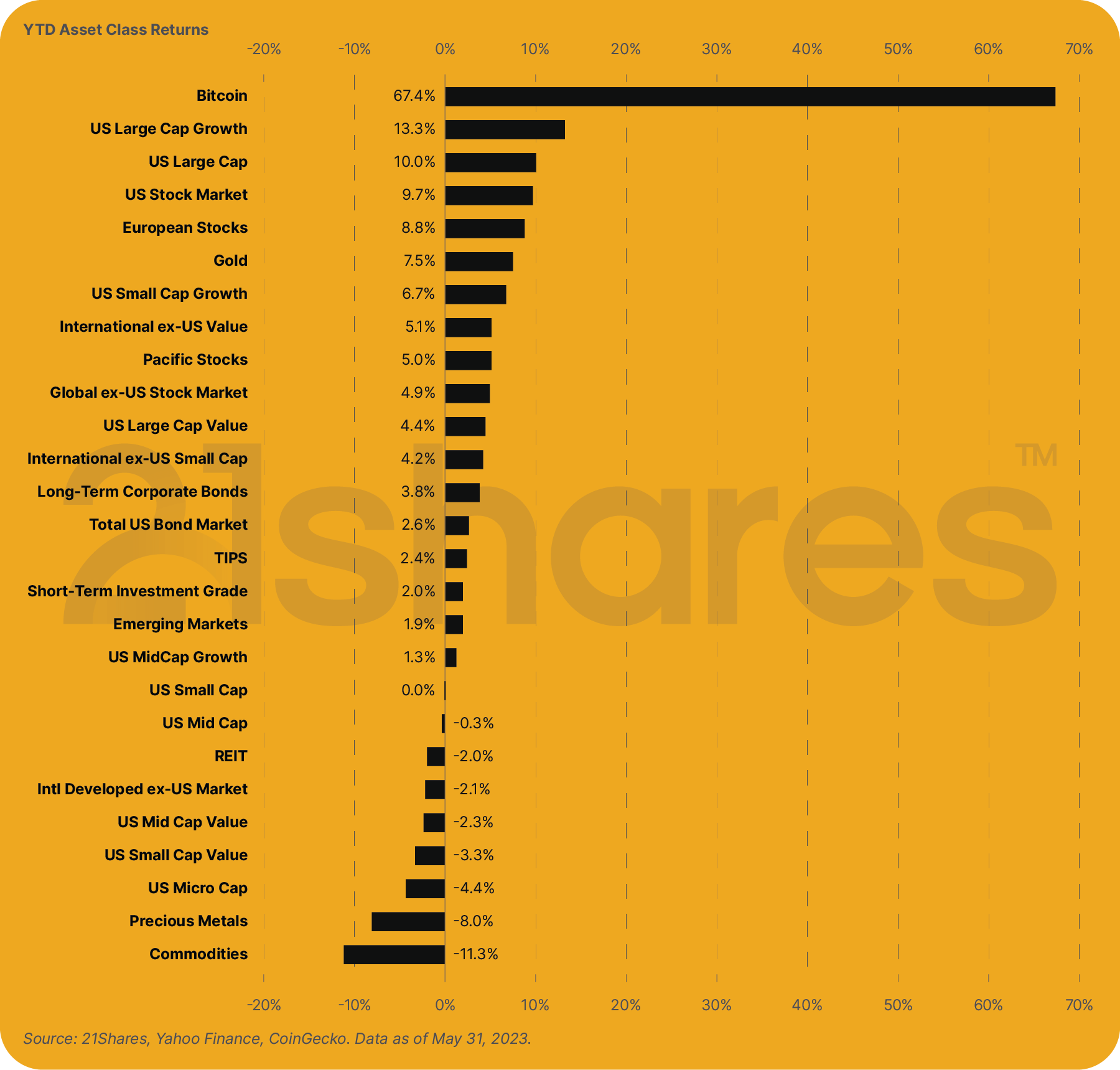

Bitcoin Outperforms Gold, S&P500, and Nasdaq in 2023 YTD

Bitcoin has registered a 60%+ year-to-date performance amidst an uncertain macroeconomic environment and fascinating ecosystem developments. BTC dominance has risen to 45%, up from 38% in December reaching its highest level since June last year.

See how to invest in Bitcoin with the largest suite of crypto exchange-traded products (ETPs).

Why 21Shares for gaining Bitcoin exposure

- 21Shares Bitcoin ETPs are 100% physically backed by the underlying Bitcoin.

- The underlying Bitcoin assets are held in cold storage by independent custodian partners (Coinbase / Copper).

- Investors are able to trade Bitcoin ETPs similar to stocks with your regular brokerage account on regulated stock exchanges.

- Investors don’t need to worry about holding Bitcoin on a crypto wallet.

ABTC

World's first spot Bitcoin ETP

21Shares Bitcoin ETP

Asset under Management (AUM): $247.44M

YTD Return*: +58.54%

Fees (p.a.): 1.49%

CBTC

Bitcoin ETP with the lowest fees

21Shares Bitcoin Core ETP

Asset under Management (AUM): $5.23M

YTD Return*: +59.37%

Fees (p.a.): 0.21%

SBTC

The only inverse Bitcoin ETP in the market

21Shares Short Bitcoin ETP

Asset under Management (AUM): $9.63M

YTD Return*: -47.57%

Fees (p.a.): 2.50%

BOLD

World's first Bitcoin and Gold ETP

21Shares Bytetree BOLD ETP

Asset under Management (AUM): $4.15M

YTD Return*: +16.73%

Fees (p.a.): 1.49%

- *Data as of June 7th, 2023.